8

👁🗨 Sesemi STR Hot Sheet | 📲 STR Mortgages

Dear Sesemi STReet Subscriber,

Thank you for your continued support as we strive to bring you the most accurate vacation rental and multi family investment information and top prospects along the Oregon Coast and beyond.

The Spring home shopping season started later than usual but real estate sales activity has picked up tremendously in just the past week.

👀 Recent Oregon Coast Market Observations:

Listings have slightly longer time on market, with the exception of very high quality listings or permitted vacation rentals, listings are staying on market an average of 1-2 weeks longer than in 2023.

Unreasonable seller expectations leading to sellers pulling homes off market. We have noticed several STR and property prospects that are adjusting their valuations or pulling their homes off the market completely since they are seeing limited showing activity or are occupied as vacation rentals for season. This provides some opportunity for investors to approach sellers with an ‘off market’ offer and eliminate or reduce buyer competition. We currently feature 10+ recently listed off market STR’s on our website.

More room for negotiation. Last year average closed sales prices were typically within .5-1% of the final listing price. So far this year we’re noticing slightly more negotiability with final sales prices 1.5-2.5% below final listing price.

Increased seller concessions and/or price reductions for inspection repairs. As buyer demand has softened slightly, the willingness of sellers to compromise post inspections has improved. We’ve had several sellers agree to extensive repair costs or reduced sales price.

Still a strong percentage of cash sales. According to the National Realtor Association somewhere between 25-35% of transactions are all cash closings. Learn how to compete with cash offers with a formal Pre Approval or Loan Commitment below…

Adjustable rate mortgages. Many buyers are entertaining ARM mortgages that are fixed for three, five or seven years. Rates can often be .5-1% lower compared to 30 year fixed mortgages, depending on occupancy type, income and credit qualifications.

Uptick in interest in ground up construction financing. Savvy investors are increasingly seeking vacant or ‘shovel ready’ land (utilities such as water, sewer/septic and power in place) or lots to develop. Many jurisdictions have restrictions on time between certification of occupation (construction completion) for STR application or usages, but for investment or development purposes investors are often unaware that they can combine the purchase of the land and construction into a single mortgage often with as little as 15-25% down. Here is an example excellent value ready to build lot in Seaside, OR. Asking $120k! 🗣

As always you can browse ALL active and eligible Oregon Coast vacation rentals listed for sale on our invite only STR HOT website SESEMI SHEET updated daily! Text for secret passcode.

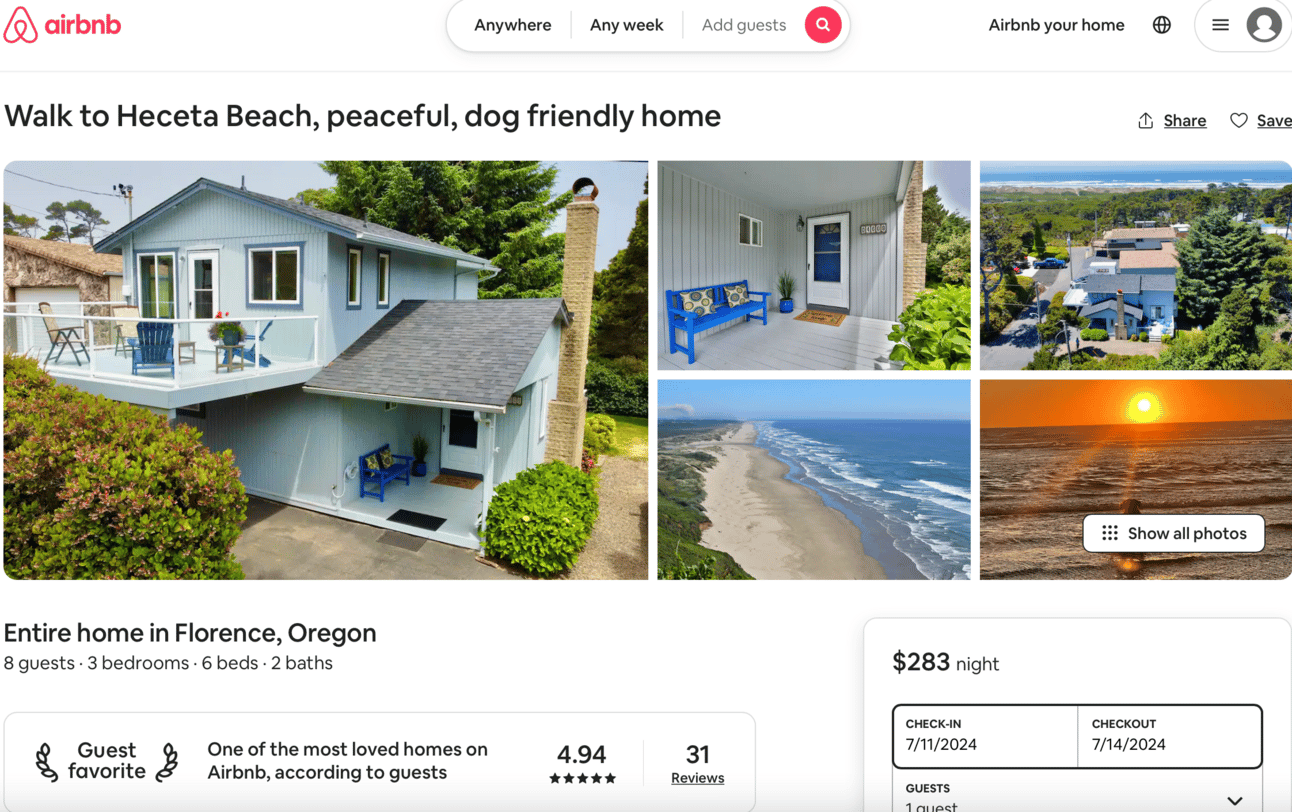

🌊 Happy 1st Anniversary - STR Client Success Story in Florence Oregon!

We consistently help investors identify, qualify and negotiate on STR acquisitions (Over 12 in just the past twelve months) but it’s the owner/operator that sustains return on investment and profitability. One top example of successful STR operation and management is our good friends Kathy & Mike from WA who purchased their ‘walk to the beach dream home with a view’ this time last year. They’ve earned SuperHost Status & their listing is a ‘rare find’ on AirBnB. Congratulations team! Check out their featured listing (or consider a stay) while we tour the coast for your next investment. 😉

💡 Mortgage Rates and Creative Finance Solutions

Mortgage rates have been hovering in the high 6% range to the low 7%’s for the majority of this year. The expectations for rate cuts have been reduced considerably from 3-4 (.25% cuts) this year to potentially just one or none..The upcoming CPI & Labor reports will provide more clarity on the direction of FED Policy. The expectations in real estate circles is that any significant interest rate cuts will stimulate home buying activity. Some tips and tools borrowers have been utilizing to secure more attractive or workable mortgage terms include seller concessions or greater down payment percentages for improved financing terms.

Seller concessions are a proportion of the sales price (typically 1-3%) that the seller contributes towards the buyers closing costs, prepaid items or interest rate buy downs. Similar to financing additional features on a vehicle, concessions can conserve capital for furniture and furnishings or initial payments while the property is getting set up for vacation rental usages.

Another potential application for seller concessions are interest rate buy downs. Essentially this is prepaid interest up front that is rolled into the loan, but reduces the borrowers effective interest rate and payment for the first 1-2-3 years. An example would be a 2/1 buy down on a qualifying mortgage rate of 6.75%. During the first year of repayment, the mortgage payments would be based off a 4.75% rate and during the second a 5.75% rate before reacting to the base rate with installment payment #25. This is a creative way to improve cash flow during the first few years of operations. On an average loan amount a $10k price reduction reduces payments nominally ($30-50) but a strong interest rate buy down would lower the comparative payment by an additional $2-300 monthly!

📉 How to lower vacation rental property management costs and fees

This week on Bigger Pockets we wrote a forum post about how STR operators can enhance their operational efficiency while potentially reducing their overall property management costs. Primarily for higher grossing revenue or luxury STR properties, hiring a full time and exclusive PM can offer significant savings in comparison to a percentage based compensation model. Many national STR management companies charge a percentage of the gross revenue (typically 20-35%) which can prohibit ROI. For properties expected to generate north of $75k+ in annual revenue, operators could consider a full time salary based employee, with cleaning fees allocated directly for their private cleaning crew.

This has a two fold effect of creating performance incentive and operators can make their cleaning fees more competitive since there is not a proportion going to a company employee (typically paid at minimum wage.) We’ve all experienced considering booking another AirBNB because the overall cost of the stay was too expensive after factoring elevated cleaning costs. For example a $350/night stay with a $300 cleaning fee can not only be a less attractive rental listing, but the actual cleaning crew with a national PM, might only profit $60-80 for 3-4 hours of work. Alternatively, a $150-200 cleaning fee paid directly to the cleaning crew can raise occupancy and quality of services rendered.

🔑 Redfin Reports luxury home prices reached a record high of $1.23M marking an 8.7% increase from the previous year.

Sales of upscale properties rose by 2.1% while mid market sales declined by 4.2%. With wealthy investors frequently closing for cash.

📝 If you’re seeking STR specific info or an intro and overview of Oregon Coast STR investment (including zoning and areas of recommendation) visit our common FAQ’s and see recent sales on my personal Fathom Realty Website.

🤩 Here are Seven STR Picks this week on the OR Coast:

👁🗨 You can also search for yourself at www.sesemisheet.com Text 541-800-0455 for the secret pass code!

BONUS: Here are 4 Top Multi Family listings in Oregon:

506 Highway 101 Rockaway Beach OR - Triplex + 2/1 SFR. Asking $879k

2214 5th St Tillamook - 13 Plex with 8 vacant! Asking $940k

1127 SW Abbey St Newport OR - SFR + Triplex Asking $995k

1857 Pear St Eugene - Campus 4Plex x 4 bedroom Asking $1.589M

Thank you for reading this week’s edition of Sesemi STReet your premier information source for vacation Rental and investment property insight throughout Oregon & California.

P.S. As the new VP of Business Development with Nationwide Mortgage Bankers my role is to provide the most robust mortgage resources to investor centric borrowers and support their long term portfolio growth. Our streamlined process and portal is extremely user friendly and we are a direct lender in ALL 50 US States and Puerto Rico!

If you are in contract or considering an offer on a property, feel free to forward your BEST quote to myself or my friend and go to lender partner of twenty years Joseph Chiofalo for a FREE and no obligation second look loan review. Your request will be reviewed within 30 minutes and NO credit pull is required. For those pending, NMB offers a 24 hour full loan commitment to help you and your agent win the offer. At a minimum, we’ll give you an honest and friendly second opinion based on over 40 years of combined lending experience. 🙂

Ask about our premier mortgage programs:

Elite Jumbo & Super Jumbo Loan Rates

2-10 Units+ & Commercial Lending

Expedited refinances and HELOCS

DSCR (Debt Service Coverage Ratio) Mortgages for investment homes

Ground Up Construction financing

Alternative income verification (1099, Bank Statement, Asset depletion)

Private & Portfolio Programs

541-800-0455

Licensed Real Estate Broker in the States of Oregon & California Fathom Realty

NMLS ID: 2297941 & VP Business Development Nationwide Mortgage Bankers